How I Built a Tax-Smart System for Natural Disaster Emergencies

When the storm hit last year, I lost more than power—I nearly lost my financial footing. It wasn’t just about insurance or savings; the tax fallout caught me off guard. That’s when I realized: emergency planning isn’t complete without a tax strategy. I started building a system—not a one-off trick, but a structured way to protect income, claim relief, and stay compliant when disaster strikes. This is how I turned chaos into control, one smart move at a time.

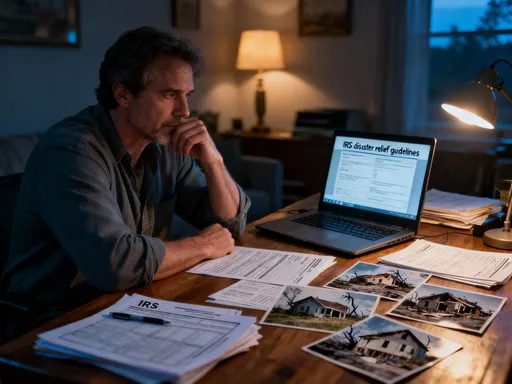

The Hidden Financial Storm: Why Taxes Matter in Natural Disasters

Natural disasters disrupt lives in ways that go far beyond physical damage. Homes are damaged, businesses shuttered, and communities displaced. Yet, one of the most overlooked consequences is the financial strain that follows—not just from rebuilding costs, but from how those costs interact with the tax system. Many families focus on emergency kits, insurance policies, and evacuation plans, but few consider how tax rules can either ease or worsen their recovery. The reality is that tax implications during and after a disaster can significantly affect net recovery, sometimes turning a manageable setback into a long-term financial burden.

The U.S. Internal Revenue Service (IRS) and other tax authorities often respond to federally declared disasters with special relief measures. These can include extended filing deadlines, penalty waivers, and unique provisions for casualty loss deductions. However, these benefits are not automatic. Claiming them requires awareness, preparation, and timely action. For example, a homeowner who suffers flood damage may be eligible to deduct uninsured losses as a casualty loss, but only if the event occurred in a designated disaster zone and if the taxpayer itemizes deductions. Without understanding these conditions, even well-intentioned efforts to recover financially can fall short.

Equally important is recognizing how disasters impact income reporting. When a business closes temporarily or a worker loses wages due to evacuation, the usual tax obligations don’t simply vanish. Yet, there are mechanisms to adjust for such disruptions. The IRS may allow self-employed individuals to revise estimated tax payments or defer certain filings. Failing to take advantage of these provisions can lead to unnecessary penalties or cash flow issues at the worst possible time. Therefore, understanding the tax landscape during emergencies is not a luxury—it is a critical component of financial resilience.

Moreover, the emotional toll of a disaster can cloud judgment, making it difficult to act quickly on tax matters. This is why proactive education and planning are essential. By learning the rules before disaster strikes, individuals can make informed decisions under pressure. The goal is not to exploit loopholes, but to ensure fairness and access to available relief. In this way, tax literacy becomes a form of protection—one that shields families from avoidable financial harm when they are most vulnerable.

Building the Foundation: Key Elements of a Disaster-Ready Tax System

Creating a tax-smart emergency plan begins long before disaster hits. It requires deliberate organization, clear documentation, and a working knowledge of how tax authorities respond to crises. The foundation of such a system lies in preparation—not panic. This means gathering and securing critical financial records, understanding eligibility for disaster-related tax relief, and establishing protocols for quick action when time is of the essence.

One of the first steps is organizing essential documents. These include tax returns from the past three to five years, property deeds, insurance policies, bank and retirement account statements, and records of major purchases or improvements. These documents are vital for substantiating casualty loss claims, proving ownership, and verifying income fluctuations. To protect against physical damage, it’s wise to store digital copies in encrypted cloud storage or on external drives kept in a safe location outside the home. This ensures access even if the primary residence is compromised.

Equally important is staying informed about how the IRS handles disaster declarations. When a region is officially recognized as a disaster area, the IRS typically issues a news release outlining available relief. This may include automatic extensions for filing and paying taxes, suspension of certain penalties, and special rules for retirement account withdrawals. Being aware of these updates allows individuals to act promptly and avoid missing deadlines that could jeopardize their financial standing.

Another foundational element is identifying which assets are most exposed to tax consequences during a crisis. For instance, primary residences, rental properties, and small business equipment may all be subject to different tax treatments if damaged. Understanding the basis, depreciation history, and insurance coverage of these assets helps in accurately calculating potential losses and planning for recovery. By mapping out this information in advance, individuals create a responsive framework that reduces decision fatigue when a disaster occurs.

Finally, establishing a relationship with a qualified tax professional familiar with disaster-related provisions can be invaluable. This person can serve as a trusted advisor during recovery, helping interpret complex rules and ensuring compliance. The foundation of a tax-smart system is not built on complexity, but on clarity and readiness. When the unexpected happens, this preparation becomes the difference between reactive scrambling and confident, strategic action.

Income Protection: Managing Earnings During Disruption

When a natural disaster strikes, one of the most immediate financial concerns is the interruption of income. Whether due to business closures, job displacement, or infrastructure failures, the loss of regular earnings can quickly destabilize household budgets. In these moments, how income is reported and managed under tax rules becomes a crucial factor in maintaining financial stability. While emergency savings and unemployment benefits provide some relief, understanding the tax implications of income adjustments can help preserve cash flow and avoid unnecessary liabilities.

For self-employed individuals and small business owners, income volatility during a disaster can complicate estimated tax payments. Normally, these taxpayers are required to make quarterly payments based on projected annual earnings. However, if a storm or wildfire forces a temporary shutdown, actual income may fall significantly below projections. In such cases, the IRS allows taxpayers to adjust their estimated payments to reflect reduced earnings. Failing to do so could result in overpayment and lost liquidity when funds are needed most. By recalculating tax obligations based on current realities, individuals can align their payments with their actual financial capacity.

Employees may also face income disruptions, particularly if their workplace is damaged or inaccessible. While wages may be temporarily halted, tax withholding does not automatically pause. In some cases, employers may continue partial pay or offer paid leave, but these arrangements vary widely. Workers should communicate with their employers about payroll status and review pay stubs carefully to ensure accurate reporting. If income is lost for an extended period, it may affect eligibility for certain tax credits, such as the Earned Income Tax Credit (EITC), which is tied to earned income levels. Planning ahead by estimating potential income gaps can help in adjusting expectations and exploring alternative support options.

Remote work dependencies add another layer of complexity. In today’s economy, many professionals rely on internet access, power, and personal devices to earn a living. A prolonged outage can render these tools unusable, effectively halting income generation. While there is no specific tax deduction for lost remote work capacity, documenting the duration and impact of the disruption can support broader casualty loss claims or insurance filings. Additionally, some freelancers may qualify for disaster-related relief programs that provide temporary income support, though these are typically administered at the state or local level.

The key to managing income during disruption is proactive assessment and timely communication. Taxpayers should monitor their earnings closely, keep detailed records of lost workdays, and consult with a tax advisor if significant changes occur. By treating income fluctuations as part of the broader emergency response, individuals can maintain compliance while protecting their financial well-being. This approach ensures that tax obligations remain manageable, even when earnings are not.

Claiming Relief: Navigating Deductions and Credits After a Disaster

After the immediate danger has passed, the focus shifts to recovery—and for many, that includes seeking financial relief through the tax system. One of the most valuable tools available is the casualty loss deduction, which allows taxpayers to deduct the cost of property damage not covered by insurance. While this provision can provide meaningful relief, it is also complex and subject to strict eligibility requirements. Understanding how to navigate it is essential for maximizing recovery without running afoul of the rules.

To qualify for a casualty loss deduction, the damage must result from a sudden, unexpected, or unusual event—such as a hurricane, wildfire, or tornado—and occur in a federally declared disaster area. The loss must also be personal in nature, meaning it applies to a primary residence, personal vehicles, or household items. Business or investment property may be eligible under different rules. The deduction is calculated as the lesser of the property’s adjusted basis or the decline in fair market value due to the disaster, minus any insurance reimbursements. Because the Tax Cuts and Jobs Act of 2017, this deduction is only available to taxpayers who itemize deductions, which limits its reach for those taking the standard deduction.

Documentation is critical when claiming a casualty loss. The IRS requires detailed records, including before-and-after photographs, repair estimates, insurance claims, and police or fire department reports. Keeping a dated log of all damage assessments and communications with insurers strengthens the case. For personal belongings, a home inventory list created before the disaster can be invaluable. Without such records, even legitimate claims may be denied due to insufficient proof.

In addition to casualty losses, other potential tax benefits may apply. For example, unreimbursed expenses related to evacuation or temporary housing might qualify as deductible if they are necessary and directly tied to the disaster. While these are not standalone deductions, they can sometimes be included as part of a broader casualty loss claim. Similarly, donations of clothing or household items to disaster relief organizations may be tax-deductible, provided they are in good condition and properly documented.

It’s also important to recognize that tax relief is not limited to deductions. In some cases, the IRS may allow the recapture of previously paid taxes or offer special credits through legislation. While these are less common, staying informed through official IRS announcements ensures that no opportunity is missed. The goal is not to seek every possible benefit, but to claim what is rightfully available under the law. With careful preparation and accurate reporting, taxpayers can ease the financial burden of recovery and move forward with greater confidence.

Asset Management: Avoiding Tax Traps When Accessing Emergency Funds

When disaster strikes, accessing emergency funds often becomes a necessity. Savings accounts, home equity, and retirement accounts may be tapped to cover urgent expenses like repairs, medical costs, or temporary housing. While these resources provide critical support, withdrawing from them without a tax-aware strategy can trigger penalties, unexpected tax bills, or long-term wealth erosion. Understanding how to access funds wisely is a cornerstone of financial resilience.

One of the most common pitfalls involves retirement accounts. Early withdrawals from traditional IRAs or 401(k)s typically incur a 10% penalty in addition to ordinary income tax. For someone already facing financial strain, this additional burden can be devastating. However, the IRS provides exceptions for qualified disaster distributions. Under certain conditions, individuals affected by a federally declared disaster may withdraw up to $100,000 from eligible retirement plans without incurring the early withdrawal penalty. Moreover, the income tax on these distributions can be spread over three years, improving cash flow during recovery.

To qualify, the withdrawal must be made within a specified timeframe after the disaster declaration, and the individual must certify that the funds are used for qualified disaster-related expenses. These include repairing a primary residence, replacing personal property, or covering necessary living expenses due to displacement. Re-contributing the funds within three years is also permitted, allowing individuals to replenish their retirement savings if their situation improves. This flexibility makes retirement accounts a viable, though cautious, source of emergency funding when used correctly.

Savings and investment accounts also require strategic management. While withdrawals from taxable brokerage accounts are not penalized, selling appreciated assets may trigger capital gains taxes. In a crisis, this tax liability can reduce the net amount available for recovery. One approach is to prioritize selling assets with minimal or no gain, such as those held at a loss or purchased at a high cost basis. Tax-loss harvesting, when done in advance, can also offset gains and reduce overall tax exposure.

Home equity lines of credit (HELOCs) and home equity loans offer another option, but they come with their own considerations. Interest on these loans may be tax-deductible if the funds are used for home improvements, but not for general living expenses. Borrowers must also weigh the risk of increasing debt secured by their home. The key is to evaluate all options with a clear understanding of the tax consequences. By planning ahead and consulting a financial advisor, individuals can access the funds they need without compromising their long-term financial health.

Coordination with Broader Financial Resilience Strategies

Tax planning for natural disasters does not exist in isolation. It is most effective when integrated with other elements of financial resilience, including insurance coverage, emergency savings, estate planning, and business continuity strategies. A siloed approach risks gaps in protection, while a coordinated system ensures that all components work together to minimize financial disruption.

Insurance plays a central role in this ecosystem. Homeowners, renters, and flood insurance policies can cover a significant portion of recovery costs. However, the way these reimbursements interact with the tax system affects eligibility for deductions. For example, a casualty loss deduction is only allowed for the portion of damage not reimbursed by insurance. If a homeowner receives a full payout for roof repairs, they cannot claim that expense as a loss. Therefore, understanding policy limits and coverage details is essential for accurate tax reporting. Additionally, some insurance payouts, such as those for personal injury or business interruption, may have different tax treatments, further underscoring the need for careful coordination.

Emergency savings serve as a first line of defense, providing immediate liquidity without the need to sell assets or take on debt. When structured properly, these funds can cover deductible expenses, temporary housing, or income gaps. Keeping them in a high-yield savings account or money market fund ensures accessibility while preserving value. Importantly, withdrawals from after-tax savings accounts do not trigger tax liabilities, making them a clean source of emergency funding. However, the size of the fund should reflect both living expenses and potential disaster-related costs, such as evacuation or uninsured repairs.

Estate planning also intersects with disaster preparedness. Powers of attorney, living wills, and trusts ensure that financial and medical decisions can be made if the primary decision-maker is incapacitated or displaced. From a tax perspective, certain trust structures may influence how relief is received or reported, particularly for multi-generational households or shared properties. Regularly reviewing and updating these documents ensures they remain aligned with current circumstances and goals.

For small business owners, integrating tax planning with business continuity plans is crucial. This includes maintaining separate business accounts, tracking expenses meticulously, and understanding how disaster relief grants or loans affect taxable income. Some programs, like those offered by the Small Business Administration, provide non-taxable assistance under specific conditions. By aligning tax strategy with operational planning, business owners can protect both their livelihood and their financial future.

Staying Compliant Without Stress: Post-Disaster Filing and Recordkeeping

Once the immediate crisis has passed, the focus shifts to recovery and rebuilding—including meeting tax obligations. While the IRS often extends deadlines for affected taxpayers, compliance remains a responsibility. The goal is not to achieve perfection under duress, but to maintain accuracy, organization, and peace of mind throughout the process. Effective recordkeeping and timely filing are the final pillars of a tax-smart emergency system.

After a disaster, taxpayers should gather and organize all relevant documentation. This includes insurance settlement letters, repair invoices, photographs of damage, evacuation receipts, and correspondence with government agencies. Digital archiving is highly recommended, as physical copies may have been lost or damaged. Using cloud storage with strong passwords and two-factor authentication ensures both security and accessibility. Organizing files by category—such as property damage, medical expenses, or temporary housing—makes it easier to compile information when preparing tax returns or responding to IRS inquiries.

Filing deadlines may be automatically extended for those in declared disaster areas, but this does not eliminate the need to file eventually. Taxpayers should monitor IRS announcements to confirm the specific relief available and the new due dates for returns and payments. In some cases, extensions apply only to certain forms or regions, so staying informed is critical. If additional time is needed beyond the official extension, taxpayers can request a further extension using Form 4868, though any taxes owed are still due by the original deadline to avoid interest.

Working with a tax professional who understands disaster-related provisions can greatly reduce stress and errors. These experts can help identify eligible deductions, ensure proper documentation, and file amended returns if necessary. They can also assist in responding to IRS notices, which may arise due to incomplete or delayed filings. While professional help comes at a cost, the value lies in accuracy, compliance, and the confidence that comes from knowing the work is done right.

Finally, the post-disaster period is an opportunity to review and strengthen the entire financial plan. What worked well? What gaps emerged? Updating emergency funds, revising insurance coverage, and refining the tax strategy based on real-world experience ensures better preparedness for the future. By closing the loop with thoughtful reflection, individuals transform a traumatic event into a lesson in resilience.

Conclusion

A natural disaster tests more than infrastructure—it tests financial judgment. When the unexpected happens, every decision counts. By treating tax planning as an integral part of emergency preparedness, individuals gain a powerful tool for maintaining control amid chaos. This is not about aggressive tax avoidance or speculative strategies; it is about foresight, structure, and the peace of mind that comes from knowing you are protected.

The system described here is not built on complexity, but on clarity. It starts with awareness, grows through preparation, and delivers results when it matters most. From understanding casualty loss deductions to managing retirement withdrawals and coordinating with insurance, each step strengthens financial resilience. The goal is not to eliminate risk—that is impossible—but to reduce vulnerability and increase confidence.

For families, small business owners, and anyone who values stability, integrating tax-smart practices into emergency planning is a wise and responsible choice. It ensures that when the skies clear, the path forward is not clouded by financial uncertainty. With the right framework in place, you’re not just surviving the storm—you’re safeguarding your future, one thoughtful decision at a time.