Love, Money, and Smart Moves: My Remarriage Asset Playbook

Navigating finances after remarriage can feel like walking a tightrope—balancing love, trust, and hard-earned assets. I’ve been there: merging lives while protecting what took decades to build. It’s not about distrust; it’s about clarity. Without the right asset strategy, even the strongest relationships can face avoidable stress. Let me share how smart, practical choices can keep both your heart and net worth secure. For many women in their 30s to 55s, remarriage brings new joy but also layered responsibilities—children from past relationships, established careers, homes, and retirement savings. The emotional warmth of a second chance at love should not be clouded by financial uncertainty. With thoughtful planning, you can honor your past, protect your future, and build a shared life grounded in honesty and mutual respect.

The Emotional and Financial Crossroads of Remarriage

Remarriage is often a celebration of resilience and renewal. After the challenges of divorce or loss, finding love again brings deep emotional healing. Yet beneath the joy lies a complex financial landscape that many are unprepared to navigate. Unlike first marriages, where couples often start with minimal assets and shared goals, second marriages typically involve individuals who have already built lives independently. One or both partners may own homes, manage retirement accounts, support adult children, or carry lingering financial obligations. These realities don’t diminish love—they simply require more thoughtful integration.

Emotionally, discussing money can feel uncomfortable, even threatening. There’s a fear that talking about prenups or wills might signal a lack of faith in the relationship. But in truth, avoiding these conversations is far more damaging. Unspoken assumptions about inheritance, spending, or shared resources can fester into resentment. Consider a woman in her early 50s who remarries after raising two children alone. She worked hard to pay off her home and save for retirement. If she assumes her new husband shares her values around frugality and long-term security—but he expects access to those funds for his adult son’s wedding—misalignment occurs. Without clear agreements, small disagreements can escalate into major rifts.

Moreover, blended families introduce additional layers. Stepchildren, though not legally entitled to inherit, may be emotionally expected to receive support. Grown children from prior relationships may worry their parent’s new spouse will displace them financially. These concerns are valid and deserve acknowledgment. The solution isn’t secrecy or avoidance—it’s open dialogue. When both partners commit to transparency, they create a foundation of trust that strengthens the relationship. Financial clarity isn’t cold; it’s compassionate. It shows respect for each person’s journey and ensures that love isn’t burdened by preventable conflict.

Why Asset Protection Isn’t About Distrust—It’s About Design

Many people hesitate to protect their assets in a remarriage because they equate it with suspicion. They worry that proposing a prenuptial agreement or setting up separate accounts will hurt their partner’s feelings. But asset protection isn’t about distrusting the other person—it’s about designing a structure that honors both individual and shared goals. Think of it like building a house: you wouldn’t skip the blueprint just because you trust the contractor. Similarly, in a remarriage, having a financial plan isn’t a sign of doubt; it’s a sign of responsibility.

Consider a scenario where one partner enters the marriage with a substantial retirement fund. Without clear guidelines, that account could be gradually depleted to cover joint expenses, leaving less for future needs or intended beneficiaries. Or imagine a situation where one spouse uses joint funds to help a grown child through a financial crisis, without consulting the other. These actions, while well-intentioned, can breed tension if not discussed in advance. The goal isn’t to restrict generosity—it’s to ensure both partners are aligned on major financial decisions.

Smart financial design allows for both independence and unity. For example, maintaining separate accounts for legacy assets—such as an inheritance or a home intended for biological children—can coexist with a jointly managed checking account for household expenses. This approach doesn’t create distance; it creates clarity. Each partner knows which resources are for shared living and which are preserved for future generations. When boundaries are clearly defined, cooperation becomes easier, not harder. There’s no need to merge every dollar to prove commitment. True partnership means respecting each other’s histories while building a future together.

Furthermore, protecting assets doesn’t mean withholding love or support. It means making intentional choices rather than reactive ones. A woman who sets aside a portion of her savings for her daughter’s education isn’t being selfish—she’s honoring a long-term promise. By communicating this goal early, she invites her new husband into her vision, turning what could be a point of conflict into an opportunity for shared understanding. Financial design, when done with care, enhances intimacy rather than diminishing it.

The Core Strategy: Tiered Asset Allocation for Blended Families

In a remarriage, a one-size-fits-all financial strategy rarely works. The complexity of blended families—multiple children, varying income levels, different financial histories—demands a more nuanced approach. That’s where **tiered asset allocation** comes in. This method organizes your finances into distinct categories, each serving a specific purpose: supporting your current lifestyle, preserving wealth for children from prior relationships, and growing assets together. By separating these goals, you reduce confusion and prevent future disputes.

The first tier is **Lifestyle Funding**. These are the assets dedicated to daily living—housing, groceries, travel, and shared experiences. This pool is typically drawn from joint income or a shared account and should reflect both partners’ spending habits and comfort levels. Contributions don’t have to be equal; they should be fair. A proportional model, where each partner contributes based on income, often works better than a rigid 50/50 split. For instance, if one spouse earns $80,000 and the other $50,000, their contributions to household expenses might reflect that ratio. This reduces resentment and acknowledges real-world differences in earning power.

The second tier is **Legacy Preservation**. These are assets intended to pass to children from previous relationships or other designated heirs. This might include a home, investment accounts, or life insurance policies. The key is to keep these funds clearly identified and protected through proper titling or trusts. For example, a woman who owns a vacation cabin she wants her children to inherit can place it in a trust that allows her and her new spouse to use it during their lives, but ensures it passes directly to her kids afterward. This way, love and legacy coexist without conflict.

The third tier is **Joint Growth**. This includes investments, retirement accounts, or real estate acquired during the marriage. These assets are meant to benefit both partners equally and should be managed collaboratively. They represent the future you’re building together—whether that’s early retirement, world travel, or a dream home. Because these funds are shared, they require joint decision-making and aligned risk tolerance. Regular check-ins on investment performance and withdrawal strategies help maintain harmony.

A real-world example illustrates this approach. A couple in their late 50s—one widowed, one divorced—combined their lives with three adult children between them. They allocated 60% of their combined income to lifestyle expenses, kept separate retirement accounts for legacy purposes, and opened a joint brokerage account for future growth. They also set up a college fund for a stepchild pursuing a graduate degree, funded from their joint budget. By defining these tiers early, they avoided arguments over priorities and created a system that honored everyone’s needs.

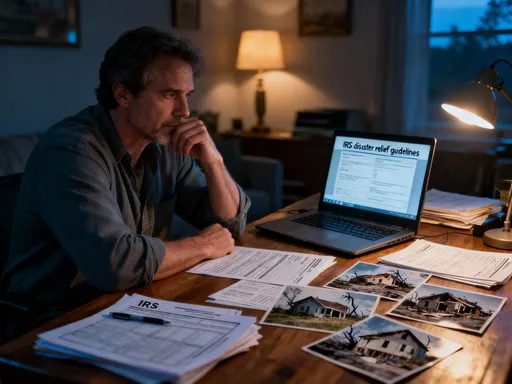

Legal Tools That Work: Prenups, Trusts, and Smart Titling

While love may be the foundation of remarriage, legal tools are the framework that protects it. Many people shy away from prenuptial agreements, viewing them as unromantic or pessimistic. But in reality, a well-drafted prenup is not a plan for divorce—it’s a plan for clarity. It outlines how assets and debts will be handled during the marriage and in the event of death or separation. For women entering remarriage with significant assets, a prenup ensures that hard-earned wealth is preserved for intended beneficiaries, such as children from a first marriage.

Equally important are **trusts**, which offer flexibility and control beyond what a will can provide. A revocable living trust, for example, allows you to manage your assets during your lifetime while ensuring they pass directly to heirs without probate. For remarried couples, a **qualified terminable interest property (QTIP) trust** can be especially useful. It lets a surviving spouse receive income from the trust during their lifetime, while the principal eventually goes to the grantor’s children. This balances spousal support with legacy goals.

Another powerful tool is **life estate deed**, particularly for the family home. Suppose a woman owns a home free and clear and wants her new husband to live there if she passes first, but ultimately have it go to her children. A life estate deed grants him the right to reside in the home for life, after which ownership transfers automatically. This avoids forcing a sale or creating tension among heirs. It’s a practical way to show care for your spouse while honoring your parental responsibilities.

Equally critical is how assets are **titled**. The way you register property, bank accounts, and investments has lasting consequences. **Tenancy by the entirety** is available in some states and offers protection from creditors while allowing automatic transfer to the surviving spouse. **Joint tenancy with right of survivorship** also ensures the surviving owner inherits the asset, but it may unintentionally disinherit children if not planned carefully. In contrast, **tenants in common** lets each partner own a specific share—say, 50%—and leave it to whomever they choose. This is often preferable in blended families, as it prevents accidental disinheritance.

Updating beneficiary designations is another essential step. Too often, people forget to change the beneficiaries on retirement accounts, life insurance, or payable-on-death accounts after remarriage. The result? An ex-spouse or deceased parent still receives the funds. This isn’t just an oversight—it can lead to legal battles and heartbreak. A simple review of all accounts with named beneficiaries can prevent such tragedies. Working with an estate attorney ensures these tools are used correctly and reflect your current wishes.

Handling Debts and Spending Styles Without Sparks

Merging finances means merging not just assets, but also debts and spending habits. One partner may enter the marriage debt-free, while the other carries student loans, credit card balances, or a mortgage. These differences aren’t moral failings—they’re realities that require thoughtful management. Ignoring them, however, can lead to friction. A spouse who feels burdened by their partner’s debt may grow resentful, especially if they see it affecting their own financial goals.

The key is to approach debt with transparency, not blame. Start by creating a full picture of all liabilities—amounts, interest rates, repayment timelines. Then decide together how to handle them. Should you consolidate? Pay them off jointly? Or keep them separate? There’s no universal answer, but a common approach is the **proportional responsibility model**. Each partner contributes to joint expenses based on income, and individual debts are managed separately unless both agree to help. For example, if one spouse has $30,000 in student debt, the other might agree to contribute a portion of joint funds toward repayment as a gesture of support—but only if it doesn’t compromise shared goals.

Spending styles also need alignment. One person may be a careful saver; the other, a spontaneous spender. These differences aren’t inherently problematic, but they require communication. A practical solution is to establish **personal spending allowances**—a set amount each month that either partner can spend without explanation. This preserves autonomy while maintaining accountability for larger purchases. Budgeting apps like Mint or YNAB can help track spending and identify patterns. Monthly “money dates” provide a neutral time to review finances, adjust budgets, and discuss upcoming expenses.

Transparency, not equality, should be the goal. It’s less important that both partners spend the same amount than that they understand and respect each other’s priorities. A woman who values home-cooked meals and thrift-store finds may clash with a husband who enjoys dining out and designer clothes. Instead of demanding change, they can agree on a shared entertainment budget that allows both lifestyles to coexist. The focus shifts from judgment to collaboration, turning money from a source of conflict into a tool for connection.

Retirement Planning When You’re Not Starting From Zero

Retirement planning in a second marriage is fundamentally different from the first. You’re not starting with a blank slate. You likely have multiple retirement accounts—401(k)s, IRAs, pensions—from previous jobs and marriages. You may be receiving Social Security from a prior union or have health care decisions already in motion. The challenge is to integrate these pieces into a cohesive strategy that supports both partners without undermining past commitments.

Start with consolidation. While you can’t merge all retirement accounts, you can streamline them for easier management. Rollover old 401(k)s into IRAs to reduce the number of moving parts. This makes it easier to rebalance portfolios and monitor performance. But be cautious: not all accounts should be combined. Inherited IRAs, for example, have special tax rules and should remain separate. A financial advisor can help navigate these nuances.

Next, review **beneficiary designations** on every account. This is one of the most overlooked yet critical steps. If you remarried but never updated your 401(k) beneficiary, your ex-spouse or a deceased parent could still inherit. That’s not just a mistake—it can cause legal and emotional turmoil. Ensure that each account reflects your current wishes, whether that’s your new spouse, your children, or a trust. Remember, beneficiary designations override wills, so they must be accurate.

When it comes to **Social Security**, remarriage affects eligibility. If you remarry before age 60, you lose the ability to claim benefits based on a former spouse’s record. But if you wait until after 60 (or 50 if disabled), you can still qualify. This makes timing crucial. A woman who was married for over ten years to a high earner may be entitled to significant benefits, but only if she plans carefully. Delaying her own benefit until 70 can also maximize lifetime income, especially if she’s the higher earner.

Health care planning is equally important. Medicare enrollment, long-term care insurance, and prescription costs all factor into retirement budgets. Couples should discuss how they’ll handle potential care needs and whether they want to purchase joint policies. Open conversations now can prevent stress later. The goal is to ensure both partners feel financially secure, with dignity and choice preserved in their later years.

Keeping the Peace: Communication Habits That Prevent Financial Fallout

No financial plan, no matter how well-designed, can survive without open communication. In remarriage, where emotions and obligations are deeply intertwined, the way you talk about money matters as much as what you decide. Many couples focus on the technical details—accounts, allocations, legal forms—but neglect the human element. Yet it’s the daily conversations, the tone of voice, the willingness to listen, that determine whether a plan succeeds or fails.

Establishing regular “money dates” can transform financial discussions from stressful confrontations into moments of connection. Set aside a quiet time each month—over coffee, during a walk, or after dinner—to review budgets, discuss goals, and check in on feelings. Use neutral language: say “our plan” instead of “your debt,” or “let’s see how we can adjust” rather than “you’re spending too much.” These small shifts reduce defensiveness and foster teamwork.

For sensitive topics—like one partner’s fear of being left out of the will or anxiety about financial dependence—consider bringing in a neutral third party. A **financial therapist** or certified divorce financial analyst can facilitate conversations with empathy and expertise. They help uncover underlying fears and align values without taking sides. This isn’t a sign of weakness; it’s a commitment to long-term harmony.

Finally, revisit your financial plan regularly. Life changes—children graduate, jobs shift, health needs evolve. Your strategy should be flexible enough to adapt. Review your estate documents every few years, especially after major events. Update investment allocations as risk tolerance changes. Celebrate milestones together, like paying off a loan or reaching a savings goal. These moments reinforce shared progress and mutual appreciation.

Ultimately, financial success in remarriage isn’t measured by portfolio size or debt reduction alone. It’s measured by peace of mind, trust, and the ability to face the future together with confidence. When love and practicality walk hand in hand, remarriage becomes not just a second chance at happiness, but a well-built foundation for lasting security.