Little Wins, Big Future: My Real Talk on Funding Early Education

Raising a child in today’s world means thinking about their future—way before they start school. I remember staring at a brochure for an early learning center, heart sinking at the price. That moment hit me: how do regular families plan for early education without breaking the bank? It’s not just about saving—it’s about smart asset allocation that grows with purpose and protects your peace. The truth is, early education isn’t a luxury; it’s a foundational investment. And like any investment, it demands planning, discipline, and a clear strategy. Ignoring it can lead to financial strain, rushed decisions, or missed opportunities. But getting it right means more than just covering costs—it means building confidence, reducing stress, and giving your child a stable start. This is not about getting rich. It’s about growing value where it matters most: in your family’s future.

The Wake-Up Call: Why Early Education Costs Can’t Be Ignored

For many parents, early education feels like a choice, not a necessity. They see preschool as optional, enrichment classes as extras, and bilingual programs as perks for families with bigger budgets. But the reality is shifting. In cities across the country, enrollment in early learning programs has become nearly universal, not because parents want to keep up with trends, but because they recognize what research has long confirmed: the first five years of life are critical for cognitive, emotional, and social development. What was once considered a convenience is now a cornerstone of a child’s educational journey. And with that shift comes a financial responsibility that cannot be postponed or underestimated.

The cost of early education varies widely, but even modest programs add up quickly. A full-time preschool can range from $8,000 to $15,000 per year, depending on location and curriculum. Add to that music classes, language immersion, or developmental playgroups, and annual expenses can easily exceed $20,000 for some families. These are not one-time fees but recurring costs, often paid monthly, with little room for delay. Unlike college, which allows years of advance planning, early education expenses begin just as families are adjusting to the financial impact of a new child—medical bills, childcare, and reduced income during parental leave. When these costs are treated as afterthoughts, families often resort to credit cards, loans, or draining emergency savings, creating long-term financial strain.

Another challenge is inflation. Tuition for early learning programs has consistently risen faster than the general rate of inflation, sometimes by as much as 4% to 6% annually. This means a program that costs $10,000 today could cost $12,000 in just three years. Families who fail to account for this growth may find themselves unprepared, forced to switch schools, reduce hours, or settle for lower-quality options. Worse, some delay enrollment altogether, believing they can wait until kindergarten. But research from early childhood development experts shows that children who attend high-quality early learning programs enter school with stronger language skills, better emotional regulation, and higher levels of curiosity—advantages that compound over time. Delaying isn’t saving; it’s sacrificing long-term gains for short-term relief.

The first step in responsible financial planning is recognizing early education as a core family expense, not a discretionary add-on. This shift in mindset changes everything. Instead of reacting to bills as they arrive, parents can begin planning during pregnancy or even before. Budgeting for early education should be as routine as planning for housing, healthcare, or transportation. It requires honesty about current finances, realistic projections of future costs, and a commitment to consistency. The goal isn’t perfection—it’s preparation. When families treat early learning as a non-negotiable investment, they create space for smarter decisions, reduced stress, and greater confidence in their choices. This awareness is the wake-up call that starts the journey toward financial resilience.

Asset Allocation Isn’t Just for Retirement—It’s for Your Child’s First Steps

When most people hear “asset allocation,” they think of retirement accounts, stock portfolios, or long-term wealth building. But the principles of balancing risk, return, and time horizon apply just as powerfully to shorter financial goals—like funding early education. The typical timeline for this expense is 0 to 5 years, which may seem too short for investing. However, even a three- or four-year window allows for strategic growth if approached with discipline and clarity. The key is aligning your investment choices with your timeline, risk tolerance, and need for access to funds. This isn’t about speculation; it’s about purposeful growth.

Time horizon is the starting point. If your child is already born, you may have as little as 12 to 36 months before preschool begins. In that case, preserving capital becomes more important than chasing high returns. A portfolio heavily weighted in stocks would expose you to unnecessary volatility—imagine saving diligently for three years, only to see your balance drop 20% in a market downturn just as tuition is due. That’s why shorter timelines call for a more conservative mix: high-yield savings accounts, certificates of deposit (CDs), and short-term bond funds offer modest but predictable returns with minimal risk. These instruments may not double your money, but they protect it from erosion.

For families with a longer runway—say, expecting a child or planning for a second child’s education—there’s room to include modest exposure to growth assets. A balanced approach might allocate 60% to fixed-income securities and cash equivalents, 30% to conservative equity funds, and 10% to inflation-protected securities. This mix allows for gradual appreciation while limiting downside risk. The goal isn’t to beat the market but to stay ahead of tuition inflation. Over four years, even a 3% annual return can make a meaningful difference when compounded across thousands of dollars in savings.

Risk tolerance also plays a role. Some parents are uncomfortable with any market exposure, preferring the safety of insured accounts. Others are willing to accept small fluctuations for the chance of higher returns. There’s no single right answer—only what fits your comfort level and financial situation. The important thing is to make intentional choices, not default to what’s familiar. For example, keeping all savings in a regular checking account may feel safe, but with near-zero interest, you’re effectively losing value to inflation. Conversely, putting everything into a single high-growth stock fund may promise excitement but carries unacceptable risk. Asset allocation brings balance. It ensures your money works for you without exposing your family’s security to unnecessary danger.

The 3-Pot Strategy: Separating Goals to Stay in Control

One of the most effective ways to manage early education savings is the “3-Pot Strategy,” a simple yet powerful framework that separates funds based on purpose and time frame. The idea is to create three distinct mental or physical accounts: the Safety Pot, the Growth Pot, and the Flexibility Pot. Each serves a specific role, helping families avoid common pitfalls like overspending, under-saving, or reacting emotionally to market changes. By assigning every dollar a job, this system brings clarity, control, and confidence to financial planning.

The Safety Pot is for near-term expenses and emergencies. This includes tuition payments due within the next 12 to 18 months, registration fees, supplies, and unexpected costs like medical co-pays or family travel. Funds in this pot should be highly liquid and protected from market loss. High-yield savings accounts, money market funds, and short-term CDs are ideal. The goal is accessibility and stability, not growth. Experts recommend keeping at least six months of anticipated early education costs in this pot at all times. This buffer prevents panic if income changes or if a program requires a sudden payment. It also ensures that daily life isn’t disrupted by financial stress.

The Growth Pot is designed for funds that won’t be needed for two to five years. These dollars can take on slightly more risk in exchange for modest appreciation. Conservative mutual funds, target-date funds with a 2027 or 2029 horizon, and dividend-paying stocks with strong track records are appropriate choices. The key is diversification—spreading investments across asset classes to reduce exposure to any single market swing. Contributions to this pot should be regular and automated, allowing compounding to work over time. Even $100 a month, invested consistently, can grow into several thousand dollars by the time preschool begins. The Growth Pot isn’t about timing the market; it’s about using time as an ally.

The Flexibility Pot is often overlooked but equally important. This fund handles changes—switching schools, adding extracurriculars, or adjusting for family circumstances like relocation or job changes. It may also cover opportunities, such as early enrollment discounts or sibling tuition reductions. This pot can include a mix of liquid assets and slightly riskier instruments, depending on how soon the funds might be needed. The amount varies by family, but a common guideline is to allocate 10% to 15% of total early education savings to flexibility. This prevents rigid planning from becoming a trap. Life is unpredictable, and a well-structured financial plan must include room to adapt.

Avoiding the Hype: What NOT to Do When Saving for Early Learning

Amid the pressure to give children the best start, it’s easy to fall into financial traps. Some parents, eager to provide every advantage, chase high-return investment schemes promising quick growth. Others pour all their savings into trendy programs without evaluating actual benefits. Emotional spending, social comparison, and misinformation can derail even the most well-intentioned plans. Recognizing what not to do is just as important as knowing the right steps. Discipline and clarity are essential to avoid costly mistakes.

One major pitfall is overexposure to volatile assets. While the stock market has delivered strong long-term returns, it’s unsuitable for funds needed within three years. Putting your entire preschool fund into a single tech stock or a speculative ETF could result in significant losses at the worst possible time. Market timing is unreliable, and no one can predict short-term swings with consistency. Similarly, chasing “hot” investment trends—cryptocurrency, penny stocks, or unregulated platforms—introduces unnecessary risk. These instruments may offer excitement, but they lack the stability required for essential family expenses. The goal is not to get rich quickly but to protect and grow value steadily.

Another common mistake is equating cost with quality. Some families sign up for premium bilingual academies or elite enrichment centers simply because they’re popular, without assessing whether the benefits justify the price. A $25,000-a-year program may offer excellent facilities, but research shows that child-to-teacher ratios, staff qualifications, and curriculum design matter more than branding. A well-run community preschool with passionate educators can deliver comparable developmental outcomes at a fraction of the cost. The danger lies in confusing status with value. Spending beyond your means for prestige can lead to debt, stress, and resentment—outcomes that harm family well-being more than they help a child’s education.

Relying solely on gifts, hand-me-downs, or unexpected windfalls is another flawed strategy. While birthday money or tax refunds can boost savings, building a plan around unpredictable income is risky. These funds are helpful supplements, not foundations. When families count on them as primary sources, they often fall short. A better approach is to treat windfalls as bonuses—redirecting them to the Growth or Flexibility Pot—but base the core plan on consistent, reliable contributions. This creates a realistic, sustainable path forward.

Making It Work: Small Habits That Build Big Results

Successful financial planning doesn’t require dramatic changes. It thrives on small, consistent habits that compound over time. For busy parents, the idea of managing investments or tracking budgets can feel overwhelming. But the most effective strategies are often the simplest. Automating contributions, reevaluating spending, and redirecting small surpluses can generate significant results without disrupting daily life. The focus isn’t on sacrifice but on intentionality—making every dollar count.

Automated transfers are one of the most powerful tools. Setting up a recurring deposit—$50, $100, or whatever fits your budget—from checking to a dedicated savings or investment account ensures consistency. These transfers happen automatically, reducing the temptation to spend elsewhere. Over time, they build momentum. For example, $75 a month grows to $4,500 in five years, even without interest. With a 3% annual return, it becomes nearly $5,000. That’s enough to cover half a year’s tuition at many preschools. The key is to start early and stay consistent, even with small amounts.

Another effective habit is redirecting windfalls. Tax refunds, work bonuses, or cash gifts can be fun to spend, but allocating even half to early education savings accelerates progress. A $3,000 tax refund, split between the Growth and Safety Pots, can significantly boost your timeline. Similarly, cutting back on non-essentials—like dining out, subscription services, or impulse purchases—can free up cash without major lifestyle changes. Skipping two takeout meals a month saves $100, which becomes $6,000 over five years with modest growth. These choices aren’t about deprivation; they’re about prioritization.

Regular financial check-ins also help. Families who review their savings goals quarterly are more likely to stay on track. These reviews don’t need to be complex—just 20 minutes to assess progress, adjust contributions, and rebalance if needed. They create accountability and reduce last-minute surprises. When small habits become routine, they build confidence. Parents begin to see themselves not as passive spenders but as active planners, shaping their child’s future one decision at a time.

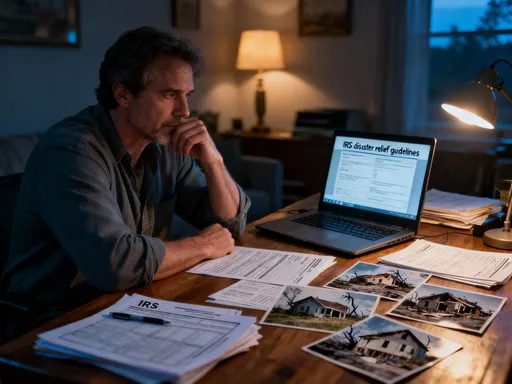

When Life Changes—Adjusting Your Plan Without Panic

No plan survives contact with reality unchanged. Job loss, health issues, divorce, or economic downturns can disrupt even the most careful financial strategy. The goal isn’t to prevent change—it’s to respond with resilience. Rigid plans fail; flexible ones endure. The key is to build adaptability into your approach from the start, so adjustments don’t mean starting over.

One way to prepare is by creating buffers. The Safety Pot should always hold enough to cover at least three to six months of anticipated costs. This provides breathing room if income drops. Additionally, maintaining an emergency fund separate from education savings protects the entire plan from being derailed by unexpected events. If a medical bill arises, you shouldn’t have to liquidate investments at a loss. Having layers of protection ensures that one setback doesn’t collapse the whole structure.

Regular monitoring helps catch problems early. If contributions fall behind for two months, it’s a warning sign. Instead of ignoring it, reassess your budget, reduce non-essential spending, or adjust timelines. Maybe preschool starts part-time instead of full-time, or you choose a more affordable program for the first year. These aren’t failures—they’re smart adaptations. The ability to revise goals without guilt is a sign of financial maturity.

Emotional resilience matters too. Financial stress can feel personal, especially when it involves your child. But setbacks don’t reflect your worth as a parent. Staying grounded, seeking support from trusted advisors, and focusing on progress—not perfection—helps maintain perspective. A delayed start doesn’t mean a lesser future. What matters is consistency over time. With flexibility and courage, families can navigate change without losing sight of their goals.

Raising Kids and Raising Value: The Bigger Picture

Funding early education is about more than money. It’s about values, priorities, and the kind of future you want for your family. Every dollar saved, every investment chosen, every habit formed sends a message: your child’s development matters, and you’re willing to plan for it. This isn’t just financial management—it’s an act of care. When asset allocation aligns with purpose, it becomes a tool for stability, confidence, and peace of mind.

The benefits extend beyond the classroom. Children raised in financially stable homes learn security, discipline, and the value of planning. They see their parents making thoughtful choices, not reacting to crisis. These lessons shape their own relationship with money and responsibility. And parents gain something too: the freedom to focus on parenting, not panic over bills. They sleep better knowing they’re prepared, not scrambling at the last minute.

In the end, it’s not about achieving perfection or keeping up with others. It’s about progress, consistency, and intentionality. Small wins—automated savings, smart choices, flexible adjustments—add up to a big future. When you fund early education wisely, you’re not just paying for preschool. You’re investing in confidence, opportunity, and a foundation that lasts a lifetime. And that’s a return no market can measure.