How I Navigated the Car Loan Maze: A Real Strategy for Smarter Financing

Remember that sinking feeling when you sign a car loan and suddenly wonder if you got played? I’ve been there—excited about my new ride, only to realize the monthly hit was tighter than expected. It wasn’t just about the payment; it was the fine print, the timing, and the market shifts I ignored. That moment changed how I see car financing. In this article, I’ll walk you through the real moves that helped me regain control—no jargon, no hype, just practical insights shaped by market realities and hard-earned lessons. This isn’t about flashy tips or get-rich-quick schemes. It’s about building confidence in your financial choices, especially when the pressure is on and the salesperson is smiling a little too warmly. You deserve clarity, not confusion.

The Hidden Trap in Car Loans No One Talks About

Many car buyers focus only on the monthly payment, believing it to be the most important number on the financing sheet. But this narrow focus can be dangerously misleading. The monthly figure is just one piece of a much larger puzzle. Beneath it lie loan terms, interest rates, and hidden fees that quietly dictate how much you’ll ultimately pay. A seemingly affordable $400 monthly payment might look manageable on paper, but if stretched over eight years with a high interest rate, the total cost of the vehicle can balloon far beyond its sticker price. This is where the real trap lies—not in deception, but in incomplete understanding.

I once leased a midsize SUV with what I thought was a great deal: $375 per month for 72 months. What I didn’t realize at the time was that the interest rate was 6.8%, and the loan term was longer than industry recommendations. By the time I ran the numbers a year later, I discovered I was on track to pay nearly $2,500 more in interest than I would have with a shorter, more disciplined loan. Two identical cars, purchased under different financing conditions, can end up costing thousands apart. That difference isn’t magic—it’s math. And it’s math most buyers never stop to calculate before signing.

Emotional decision-making plays a big role in this. Walking onto a dealership lot, the smell of new leather, the polished finish, the promise of freedom—these sensations can cloud judgment. Sales professionals are trained to guide attention toward affordability, not total cost. They’ll emphasize how “easy” the payment fits into your budget, but rarely break down how much extra you’re paying over time. The key is to shift focus from short-term comfort to long-term value. That means asking not just “Can I afford this payment?” but “Is this the smartest way to finance this purchase?” Only then can you begin to see the full picture.

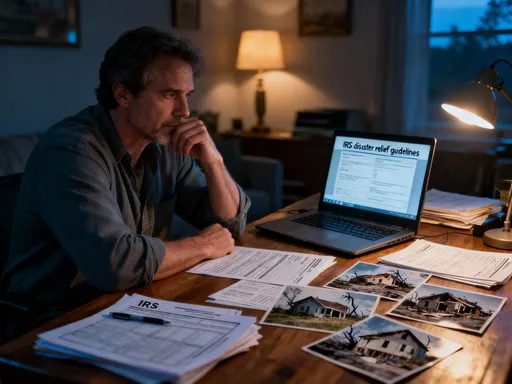

Why Market Conditions Dictate Your Loan Game Plan

Car financing doesn’t happen in isolation. It’s deeply influenced by broader economic forces—interest rates set by central banks, supply chain fluctuations, inventory levels, and seasonal incentives. When I first tried to buy a family sedan, I did so during a period of low inventory and rising demand. As a result, dealer financing offers were less competitive, and interest rates were climbing. I accepted a rate of 6.2%, thinking it was standard. Six months later, after delays caused by supply issues, I researched again and found that similar loans were being offered at 5.1%—a full point lower. That difference would have saved me over $1,300 in interest on a $25,000 loan.

Timing your purchase to align with market cycles can make a significant difference. Automakers often release new models in the fall, which means dealerships are eager to clear out previous year models in late summer. This creates opportunities for better financing deals, cash rebates, and lower interest rates. Similarly, months like January and February tend to be slower for car sales, prompting dealers to offer more attractive terms to meet quotas. Being aware of these patterns allows you to wait for the right moment rather than rush into a decision based on urgency or emotion.

Supply chain dynamics also play a role. During periods of semiconductor shortages or shipping delays, vehicle availability drops, giving dealers more pricing power. In such times, financing incentives may be limited, and loan terms less flexible. Conversely, when inventory is high, lenders and manufacturers compete for buyers, leading to 0% APR offers or cash-back promotions. These are not random events—they follow predictable trends. By tracking industry reports and staying informed through consumer automotive publications, you gain leverage. Knowledge becomes your negotiating tool, even before you step into a dealership.

Credit Score: Your Silent Negotiating Partner

Your credit score is more than a number—it’s a financial voice that speaks for you when you’re not in the room. Before I applied for my first car loan, I assumed my credit was “okay.” I paid my bills on time and didn’t carry large balances. But when I checked my score, it was only 662—solidly in the “fair” range. That single digit kept me from qualifying for the best interest rates and manufacturer-backed financing programs. I was automatically placed in a higher risk category, which meant higher borrowing costs. It wasn’t until I took steps to improve my score that I saw real savings.

I began by reviewing my credit report for errors. I found a medical bill that had been incorrectly reported as past due, despite timely payment. After disputing it, the correction boosted my score by 28 points. I also reduced my credit utilization by paying down a few smaller balances, which contributed another 15-point increase. Within four months, my score reached 705—solidly in the “good” range. When I reapplied for financing, my interest rate dropped from 6.8% to 5.3%. On a $28,000 loan over five years, that difference saved me $1,142 in interest.

Lenders use credit scores to assess risk. A higher score signals reliability and financial discipline, making you eligible for better loan terms. But even if your credit history isn’t perfect, there are ways to improve your position. Some lenders offer programs for borrowers rebuilding credit, often with slightly higher rates but fair terms. Credit unions, in particular, are known for more personalized underwriting and may consider your full financial picture, not just a three-digit score. The lesson is clear: never apply for a car loan without first knowing your credit standing. That knowledge gives you power—the power to negotiate, to shop around, and to avoid being steered toward unfavorable deals.

Dealership Financing vs. Outside Lenders: Who Really Wins?

Walking into a dealership, the offer of “instant financing approval” can feel like a relief. No waiting, no paperwork, no uncertainty. But convenience often comes at a cost. I learned this the hard way when I accepted dealer financing on my first purchase, only to discover weeks later that my local credit union offered the same loan at nearly a full percentage point lower. The dealer had marked up the interest rate, a common practice known as a “rate markup” or “dealer reserve,” where the lender pays the dealer a commission for securing the loan. That markup was invisible to me at the time—but it cost me hundreds over the life of the loan.

Outside lenders—such as banks, credit unions, and online financial institutions—often provide more transparent and competitive rates. Credit unions, in particular, are member-owned and typically offer lower rates because they’re not driven by profit maximization. Online lenders have lower overhead, which allows them to pass savings to borrowers. In contrast, dealership financing is often designed to maximize profit for both the dealer and the affiliated lender. While some manufacturer-backed programs (like 0% APR offers) can be excellent, they usually come with strict eligibility requirements and may only apply to specific models or trim levels.

The smartest move I made was getting pre-approved before visiting any dealership. I applied with three lenders: my credit union, a national bank, and a reputable online lender. Each provided a loan estimate with clear terms. Armed with that information, I walked into the dealership with confidence. Instead of relying on their financing department, I could compare their offer to my pre-approved rates. This shifted the balance of power. Suddenly, I wasn’t the one asking for a deal—I was the one evaluating their proposal. In one instance, the dealer matched my credit union’s rate to keep the sale. In another, they offered an additional cash incentive to win my business. Pre-approval doesn’t lock you in, but it gives you leverage, clarity, and control.

Loan Term Trade-Offs: Short Pain or Long Drain?

One of the most common misconceptions in car financing is that lower monthly payments are always better. On the surface, stretching a loan over 72 or 84 months makes the payment more manageable. But this comfort comes with a hidden cost: significantly more interest paid over time. I once considered an 84-month loan because the monthly payment was $75 lower than a 60-month option. It seemed like a win—until I calculated the total cost. That extra comfort added over $2,100 in interest and kept me paying long after the car’s value had dropped below the loan balance. I would have been upside down—owing more than the car was worth—for years.

Shorter loan terms, while requiring higher monthly payments, reduce total interest and help you build equity faster. A five-year loan at 5.5% on a $30,000 car costs about $4,300 in interest. The same loan over seven years costs nearly $6,100—an extra $1,800. That’s money that could have gone toward savings, home repairs, or family needs. The longer the term, the more you pay for the privilege of driving the car. And since vehicles depreciate quickly—losing 20% to 30% of value in the first year—being locked into a long loan increases the risk of negative equity, especially if you need to sell or trade in early.

The key is balance. If a shorter term creates cash flow strain, consider adjusting other parts of the budget or looking at a less expensive vehicle. Some buyers find success with a 60-month loan on a reliable used car rather than stretching for a new model. Others choose to make larger down payments to reduce the loan amount and qualify for shorter terms. The goal isn’t to eliminate monthly pain entirely, but to avoid long-term financial drain. By projecting total costs and aligning the loan with your income stability, you make a choice that supports your overall financial health, not just your immediate comfort.

Smart Moves to Slash Your Total Financing Cost

Once you’ve secured a loan, the work isn’t over. How you manage the repayment can have a meaningful impact on the total cost. I experimented with several strategies to pay off my car loan faster and save on interest. One of the most effective was switching to biweekly payments. Instead of paying once a month, I paid half the monthly amount every two weeks. Because there are 52 weeks in a year, this results in 26 half-payments—equivalent to 13 full monthly payments annually. That extra payment each year reduced my loan term by 14 months and saved me $832 in interest on a $26,000 loan.

Another simple but powerful habit was rounding up my monthly payment. My loan required $427 per month. I set up automatic payments for $450. The extra $23 didn’t feel like a sacrifice, but over five years, it reduced my payoff time by eight months and cut interest by $510. It’s a small effort with real returns. Similarly, I used unexpected income—like tax refunds or work bonuses—to make occasional lump-sum payments toward the principal. Each time, I saw the loan balance drop faster and the interest accrue more slowly. These weren’t drastic changes, but they added up.

Not all strategies were equally effective. I tried a refinancing offer after 18 months, but the closing costs and slightly lower rate only saved me $200 over the remaining term—not enough to justify the effort. Another time, I considered a loan deferment during a tight month, but realized it would extend the loan and increase total interest. The lesson? Focus on methods that directly reduce principal or shorten the term. Avoid anything that adds fees or pushes payments further into the future. Small, consistent actions—like biweekly payments, rounding up, and occasional extra payments—can quietly transform your debt journey without disrupting your lifestyle.

Building a Car Loan Strategy That Fits Your Life

Every financial decision should reflect your unique circumstances. After my early missteps, I created a personal car financing checklist that considers more than just the vehicle or the rate. It includes income stability, household expenses, future goals like home ownership or education funding, and emergency savings. Before applying for any loan, I ask myself: Does this payment fit comfortably within my budget, even if income fluctuates? Can I make a down payment of at least 20% to avoid negative equity? Is the loan term aligned with how long I plan to keep the car?

I also evaluate total ownership costs, not just the loan. Insurance premiums, fuel efficiency, maintenance estimates, and depreciation all factor into the decision. A car that’s cheap to finance might be expensive to maintain. By using online calculators and manufacturer data, I project five-year ownership costs and compare models side by side. This holistic view prevents me from falling for a low monthly payment that hides long-term expenses.

Flexibility is another key element. Life changes—job shifts, family growth, relocation—and your financial plan should be able to adapt. I avoid loans that lock me into rigid terms or high penalties for early payoff. I prioritize lenders who allow extra payments without fees and offer clear, transparent statements. This gives me control and peace of mind. A car loan doesn’t have to be a burden. When approached with planning, awareness, and discipline, it becomes a tool—a way to access reliable transportation while staying on track with broader financial goals.

The goal isn’t perfection. It’s progress. It’s making better choices today than you did yesterday. It’s learning from mistakes and using that knowledge to build confidence. By understanding the forces that shape car financing—the market, your credit, the terms, and your own habits—you gain the power to make decisions that serve you, not the system. That’s the real win.